- by Admin

- in News & Legislation

Stamp duty holiday: the perfect storm

The stamp duty holiday has changed things for buyers and for estate agents alike – but with a limited time frame, savings of £15,000 and some essential teams still running on skeletal staff, it’s not as smooth sailing as you might think…

Before the stamp duty holiday

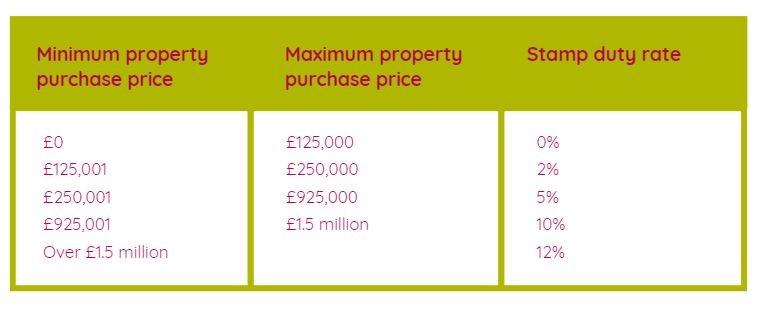

After the stamp duty holiday (discounted until 1st July 2021)

As you can see, stamp duty on a £500,000 property pre-stamp duty holiday was £15,000, so for first time buyers, now is a very tempting time to move, especially with the new 5% deposit to put down on that new pad. Homeowners will also see this time as a chance to get up the next rung of the property ladder, perhaps adding that important extra bedroom or garden. In fact, the stamp duty holiday could make the difference between moving home or staying put…

Is now the right time to buy?

At the end of last year, we saw many sellers wanting to move out of flats and into their next property, and we were excited to help buyers take advantage of the large tax saving. The £15,000 stamp duty saving (based on a £500,000 purchase) significantly boosts a first time buyer’s chances of getting on the property ladder, leaving many buyers suddenly £15,000 better off! Plus, with the average deposit reducing from £50,000 to just £25,000 at 5%, these conditions have made it the perfect time to buy.

However, the consequence of this seemingly perfect time to buy has also created a perfect storm. The conveyancing process with third party search agencies, surveyors, electricians etc can take on average three months, but with the pandemic impacting on people working from home and staff on furlough, this increase in transactions has only lengthened the time it takes to progress from point of offer to completion. This is without then factoring in chains. There are also added complications, such as recommendations for gas, asbestos and electrical inspections during the purchase process and the additional ESW1 certificate (external wall survey/cladding).

Under pressure

First time buyers, new to the market and understandably keen to take advantage of the large savings, has caused ‘conditional offers’ linked to completion dates happening within the stamp duty window, which of course has a knock on effect on any chain.

For example, if a buyer and seller have agreed a sale and set a completion date with no wiggle room, it can only lead to disaster and disappointment along the way, with many asking, ‘Why is the buyer taking so long?’, ‘Should we pull out of the sale and remarket the property, whist there is still chance of finding a buyer during the stamp duty holiday?’

With this much pressure and anxiety to close a sale before the stamp duty holiday is over – coupled with the slower process – moving house can suddenly feel more stressful than ever before! Our advice? Be patient. At Urban Village, we promise to reassure and update you every step of the way through the sales process, using the traditional key milestones and managing all your concerns and expectations.

Stamp duty holiday post-October 1st

From 1 October 2021, you’ll pay no stamp duty on properties costing up to £125,000, unless you’re a first-time buyer. So, while you might miss out on the stamp duty holiday, you can still make some significant savings later on in the year.

At Urban Village, we are committed to finding your next dream home and making the buying and selling process as simple and headache-free as possible. We also know the local area like the back of our hand, so we can advise on schools, gyms and even the best place to go for a run on Sunday afternoon. Email us on info@urbanvillagehomes.com to book a viewing today or get your property on the market.